Describe verbally what happens to the marginal product – Microeconomics

1. Consider the aggregate production function for Sambia:

Y = 10K1/2L1/2

where Y is real GDP, K is units of capital, and L is units of labor. Labor and capital are the only inputs used in Sambia to produce real GDP. Initially K is equal to 144 units. Use this information and Excel to answer this set of questions.

a. Fill in the following table (you will need to expand it from the truncated form provided here). Round all your answers to the nearest hundredth.

|

L |

K |

Y |

Marginal Product of Labor (MPl) |

Labor Productivity (Y/L) |

|

0 |

144 |

|

— |

— |

|

1 |

144 |

|

|

|

|

2 |

144 |

|

|

|

|

. |

. |

|

|

|

|

. |

. |

|

|

|

|

. |

. |

|

|

|

|

100 |

144 |

|

|

|

b. Use Excel to graph the relationship between L and Y: measure L on the horizontal axis and Y on the vertical axis.

c. Describe verbally what happens to the marginal product of labor as the level of labor usage increases in Sambia. Explain the intuition for this change in the marginal product of labor.

d. As labor increases, what happens to labor productivity? Explain why labor productivity exhibits this pattern.

e. Suppose the amount of capital in Sambia increases to 225 units due to the enactment of legislation by the government that encourages investment spending. In words describe how this change in capital will cause the aggregate production function to change.

f. Given the change in capital described in (e), fill in the following table (you will need to expand it from the truncated form provided here).

|

L’ |

K’ |

Y’ |

|

0 |

225 |

|

|

1 |

225 |

|

|

2 |

225 |

|

|

. |

. |

|

|

. |

. |

|

|

. |

. |

|

|

100 |

225 |

|

g. Use Excel to graph the original aggregate production function and the new aggregate production function in a graph with L on the horizontal axis and Y on the vertical axis. Does the graph support your prediction in (e)?

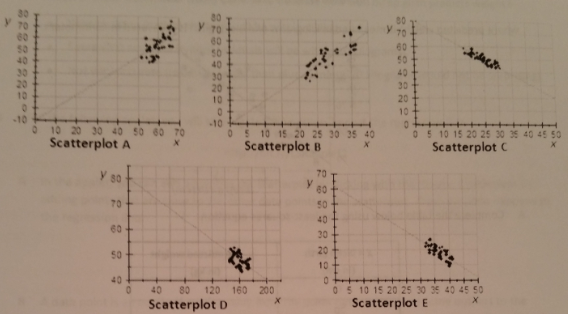

2. Use the graph below of an economy’s aggregate production function to answer the following set of questions. Assume this economy uses only capital (K) and labor (L) to produce real GDP. Furthermore assume that the level of technology is held constant in the graph.

a. Suppose this economy is initially producing at point D but then moves to point E. Explain verbally the change in the economy that results from this movement.

b. Given the change in (a), what happened to labor productivity? Explain your answer.

c. Suppose that the economy is initially at point D and then something changes in this economy so that the economy produces at point B. Describe verbally what changed and then comment on how this movement from point D to point B affects labor productivity.

d. Given the change in (c), describe what happened to capital productivity as you moved from point E to point C. [Hint: you might want to think about drawing the aggregate production function with respect to capital-that is, draw a graph with capital on the horizontal axis and real GDP on the vertical axis and then do the analysis of the change described in (c).]

3. Consider the loanable funds market for an economy. Initially the government of this economy is running a balanced budget. You are told that the supply of loanable funds curve is linear and that at an interest rate of 8%, $6,000 worth of loanable funds are supplied and at an interest rate of 4%, $3,000 worth of loanable funds are supplied. You are also told that the demand for loanable funds curve is linear and when interest rates are at 1%, $6,000 worth of funds are demanded and when the interest rate is 7%, no funds are demanded. Assume that this economy is initially a closed economy.

a. Given the above information, write an equation for the supply of loanable funds curve where r is the interest rate and Q is the quantity of loanable funds supplied.

b. Given the above information write an equation for the demand for loanable funds curve where r is the interest rate and Q is the quantity of loanable funds demanded.

c. Given the above information, what is the equilibrium interest rate and the equilibrium quantity of loanable funds?

d. Suppose the government increases government spending by $2000 while raising taxes by $250. What do you predict will happen to the interest rate in the loanable funds market given this information? What do you predict will happen to the equilibrium quantity of loanable funds given this information? Explain your answer.

e. Given the information in (d), calculate the new equilibrium interest rate and the new equilibrium quantity of loanable funds.

4. Consider the loanable funds market when answering this set of questions.

a. What are the three sources of savings for an economy?

b. Suppose the government runs a deficit. If we want to model this deficit on the supply side of the loanable funds market, then how will this deficit affect this curve? Explain your answer.

c. Suppose the government runs a deficit. If we want to model this deficit on the demand side of the loanable funds market, then how will this deficit affect this curve? Explain your answer.

d. Suppose that exports equal $1200 and imports equal $1400. Given this information, what is the impact of net capital inflows on the supply of loanable funds curve?

5. Use the loanable funds market to answer the following questions. Assume this market is initially in equilibrium.

a. Suppose that consumer confidence decreases and businesses anticipate that the next few quarters will be a difficult time for their businesses. Analyze the impact of this on the loanable funds market: identify any curves that shift and identify what happens to the equilibrium interest rate, the equilibrium quantity of loanable funds in the market, and the level of loanable funds demanded for investment.

b. Suppose that the government after several years of running a balanced budget passes a budget that results in a budget deficit. Analyze the impact of this on the loanable funds market: identify any curves that shift and identify what happens to the equilibrium interest rate, the equilibrium quantity of loanable funds in the market, and the level of loanable funds demanded for investment.

c. Suppose the loanable funds market is initially in equilibrium. Then, the economy decreases its trade deficit. Holding everything else constant, what do you predict will happen to the interest rate in this economy?